The first IKBS research project was started in association with the Alvey IKBS Community Finance Club (ALFEX). The Club was producing Expert Systems for use in the financial sector. The financial sector, being an important part of the UK economy, expert systems were seen as a competitive tool in this area. The Club consisted of a consortium of UK companies and it developed two related expert systems in the domain of corporate finance. One was a Source of Finance Advisor, which assessed the most suitable means of raising money for a company with certain needs, and the second was a market assessor to determine the health and future prospects of a high-technology retail company.

The aim of the Informatics project, called PARALFEX (Alvey IKBS approved proposal 077, starting in November 1985), was to use the Knowledge Base produced by the Club to investigate the extent to which Knowledge in Expert Systems could be made easier to maintain, modify or use for different purposes. In particular, the quality of explanations provided by the original system of its line of reasoning and conclusions was often poor; in high-risk areas, good quality explanations were seen as vital to the acceptability of a system.

The PARALFEX research project at RAL had access to both the expert systems developed for the Club and the transcripts of the knowledge elicitation sessions with the experts. The first development was a re-implementation of the Source of Finance Advisor with a graphical explanation system. The design chosen was versatile and re-usable. Graphical output was seen as preferable to canned text in providing appropriate explanations.

Initially an expert loan advisor, based on the knowledge elicitation transcripts provided by the Club, was developed into an expert system by Gordon Ringland using the Savoir shell on an IBM PC. This Source of Finance Advisor (SOFA) was then designed and implemented in the AI toolkit ART. The first stage was to duplicate Savoir's inference mechanism and to represent two of the six finance options. A graphical interface was added, based on a user-controlled display of the network of dependencies and the use of meters to show desirability of options. The interface was intended to allow immediately understandable and versatile explanations. After refinement of this interface, the remaining finance options were then added. The original plan was based on the delivery of a large working knowledge base from ALFEX in February 1986 but the first version was buggy and unstable and it was some time later before a stable version was delivered. A series of demonstrations to financial experts confirmed that the PARALFEX system was much more comprehensible than those developed with conventional expert systems shells with their limited explanation facilities. Gordon Ringland was the instigator of the project and Charlie Kwong did most of the set up work on the Symbolics.

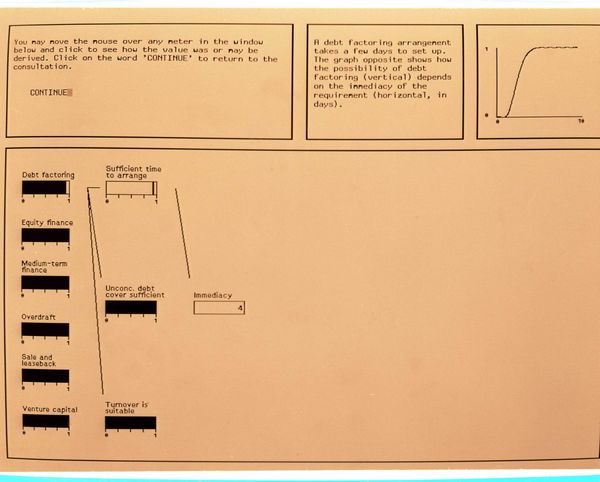

The figure below shows a typical screen during a consultation with the Source of Finance Advisor. The six finance options were represented by desirability meters at the left of the main screen. The black regions indicate that the desirability of the option is unknown: they shrink to single points as the consultation progresses. In the figure, the options of debt factoring, equity finance and overdraft have all been eliminated (they have desirabilities of zero), medium term finance have been completely investigated and has a desirability of about 0.8, the desirability of sale and leaseback is so far completely unknown while venture capital is not fully investigated but has a desirability of less than 0.5. The user, seeking an explanation of why overdraft has been eliminated, has requested a display of its contributing factors. All the conditions shown in the second rank of meters have to hold for an overdraft to be viable. It can be seen that, in this case, the term of the overdraft is too long. Investigating further, the user has the relationship between the term and overdraft possibility displayed in the top right hand window. In general, the network of contributing factors may be displayed under user control to show in an immediately understandable form why conclusions are reached. This is particularly useful for what if? questioning and for assisting in the knowledge acquisition process as, in both cases, immediate visualisation and feedback is very valuable.

The project was completed in March 1989. The two main themes of the project, graphical explanation and knowledge base architectures for the financial domain, were both brought to a successful conclusion.

The Source of Finance Adviser, the project's testbed system, had its graphical interface considerably enhanced. One aim was to enable a mode of consultation whereby the user directed progress. This was done by the user volunteering the information which would lead to determining whether a source of finance was feasible or not. The second aim was to allow the user to hypothesize about different situations. It was eventually possible for the user to change earlier inputs and see in a consistent way the effects on the viability of the sources.

The explanation mechanism was made more flexible over the project's life by allowing the user to look at the explanation for any entity in the currently visible network and allowing the network to be expanded at any time with mouse clicks on the finance options.

A general knowledge base architecture was developed using the Source of Finance Adviser as a reference to stimulate and test ideas. The architecture had two elements: an inheritance network of entities in the domain, and problem solving contexts. The inheritance network achieved both abstraction and explicitness of knowledge, which was shown to be vital for high-quality explanation of reasoning and conclusions. Entities in the knowledge base represented domain concepts, general and particular, and represented their stereotypical form. Specialised types and instances of concepts inherited their properties by default (e.g. control knowledge of how to obtain a value for the entity). Any differences from the default had to be explicitly specified. This made for a better understanding of what reasoning was being done and why. In addition, the representation of control knowledge was a simple and uniform one which enforced explicitness about the ordering of the investigation, something which in rule-based expert systems was too often encoded implicitly in the rule order.

Problem solving contexts were a means of representing situations where, as a result of making an assumption or reaching a conclusion, a whole mass of new information becomes available to the problem solver. An example used was the knowledge of expected financial ratios which became available when a company's market sector was known. Such knowledge was represented declaratively; and integrated with the inheritance network by having a context declaration associated with an entity in the knowledge base specifying what new values were acquired when that entity was being or had been evaluated.

See also: